Dti car loan calculator

For International Toll Free Intl Access Code800-8888-7222. And whether the money youd spend paying off the car loan in a lump sum would be better spent elsewhere such as paying down high interest credit card balances or building an emergency fund.

Debt To Income Ratio Calculator On Sale 59 Off Www Wtashows Com

Please note this calculator is for educational purposes only and is not a denial or.

. Normally the front-end DTIback-end DTI limits for conventional financing are 2836 the Federal Housing Administration FHA limits are 3143 and the VA loan limits are 4141. For Domestic Toll Free 1-800-10000-7222. To get a USDA loan you must have a DTI of less than 41.

In addition to your DTI ratio lenders may look at your credit history current credit score total assets and loan-to-value LTV ratio before deciding to approve deny or suspend the loan approval with. A higher DTI debt-to-income level may be allowed. To make the right decision consider your credit history credit score and credit mix.

USDA loans can only be used to buy and refinance homes in eligible rural areas. Annual real estate taxes. The Bureau proposes to amend the General QM definition in Regulation Z to replace the DTI limit with a price-based approach.

Secured loans are tied to collateral assets such as a car or a home. But there can be added costs. Use our car loan to value calculator to evaluate your cars LTV ratio and know how a lender may view your cars LTV when you apply for a car loan.

Paying off your car loan will lower your DTI. Others will offer refinance loans to borrowers with LTVs over 125 but may require a higher credit score lower DTI or other condition in order to lessen the risk to the lender because a. You have a lot of loan options as a homebuyer but fixed-rate mortgages are the most commonly used.

The above calculator provides monthly payment estimates for any type of financing breaking payments down into their essential components. The Bureau is proposing a price-based approach because it preliminarily concludes that a loans price as measured by comparing a loans annual percentage rate to the average prime offer rate for a comparable transaction is a strong. If you have a car or home loan.

Well help you understand what it means for you. All loans are either secured or unsecured. Feel free to use our House Affordability Calculator to evaluate the debt-to-income ratios when determining the maximum home mortgage loan amounts for each qualifying.

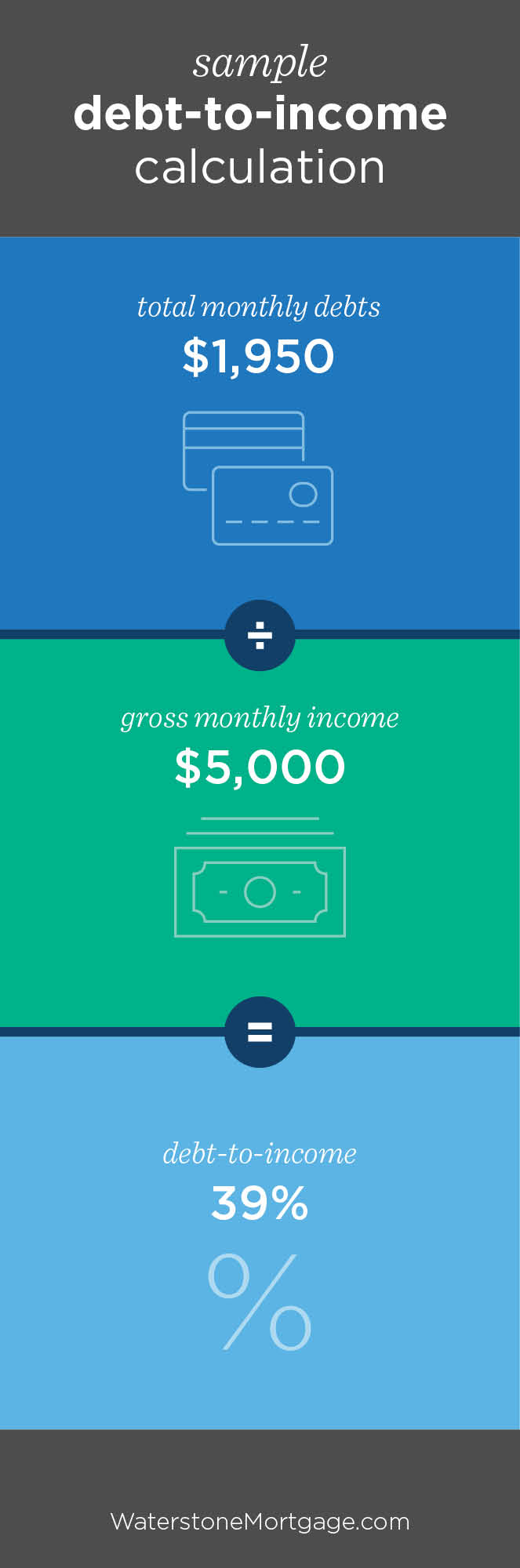

Many mortgage lenders rely on a debt-to-income DTI calculation to assess your ability to pay for a loan. New cars arent cheap and unless you have a pile of cash sitting around youll probably need to finance your vehicle. DTI ratio calculates the proportion of a persons gross income that is going to housing costs.

The price of the car you want to buy the price given to you by the dealership. Your debt-to-income ratio also determines whether youre eligible for the type of loan you want and improving your DTI can help you get lower mortgage rates. Your debt-to-income DTI ratio and credit history are two important financial health factors lenders consider when determining if they will lend you money.

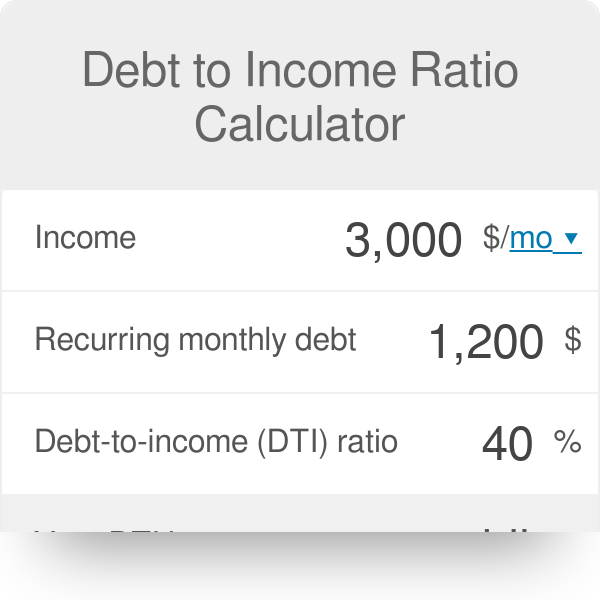

The interest rate on the car loan and potential savings. How to Calculate an Auto Loan. Use this calculator to compute your personal debt-to-income ratio a figure as important as your credit score which provides a snapshot of your overall financial health.

An FHA construction loan will have a few more stipulations as well such as land ownership involved in the. The value of your trade-in if you have one the value of your existing vehicle which youll usually trade in at. USDA loans have a couple of unique requirements.

Lenders factor DTI for mortgage loans mortgage refinancing and home equity products. Our fixed-rate mortgage calculator can help you figure out if a 15-year or 30-year mortgage is a better match for both your current financial situation and your future earnings. Generally the higher the value of the property the larger the loan but lenders will also consider your credit history.

To determine your own DTI ratio divide your debts student loans car loan etc by your monthly gross income. Or even a credit card for that matter the amount you pay back each month reflects principal and interest payments applied toward the cost of purchases. To calculate u2018how much house can I affordu2019 a good rule of thumb is using the 2836 rule which states that you shouldnu2019t spend more than 28 of your gross monthly income on.

Your down payment a sum of money you pay upfront toward the value of your car. Key benefits of this loan compared to one you would secure at a bank include. To calculate your estimated DTI ratio simply enter your current income and payments.

Federally-insured program with specific advisors and resources. Home-buyers who are unsure of which option to use can try the Conventional Loan option which uses the 2836 Rule. Reduced down payments even as low as 35.

To calculate an auto loan you need to determine several factors. In general home-buyers should use lower percentages for more conservative estimates and higher percentages for more risky estimates. For example if your debts which include your student loans and car loan reach 2000 per month and your income is 8000 per month your DTI is 25.

See the results below. People who bought cars at the end of 2020 borrowed an average of 35228 for. Buy Car Calculator.

To qualify for the loan your front-end and back-end DTI ratios must be within the 2836 DTI limit calculator factors in homeownership costs together with your other debts. The lower your DTI the more likely you are to qualify for a home-related loan. The lower your DTI the better off youll be.

Monthly minimum credit card payments. DTI less than 36 Lenders view a DTI under 36 as good meaning they think you can manage your current debt payments and handle taking on an additional loan. Call Our Hotline 632 8877-7222.

The maximum DTI for FHA loans is 57 although its decided on a case-by-case basis. DTI between 3643 In this range lenders get nervous that adding another loan payment to your plate might be challenging especially if an emergency pops up. With a secured loan you are leveraging your personal property to obtain the funds.

This calculation compares your monthly gross income typically from the income sources above to your monthly debt load. A 20 DTI is easier to pay off during stressful financial periods compared to say a 45 DTI. Viable debt sources include.

Our debt-to-income calculator looks at the back-end ratio when estimating your DTI because it takes into account your entire monthly debt. Determine how big of a loan you can afford to repay based on a monthly maximum repayment set interest rate and term. Paying off your car loan early can help lower your monthly payments and interest.

What Is Dti And How Does It Affect Your Mortgage Eligibility A D Mortgage Llc

Dti Mortgage Calculator Cheap Sale 57 Off Www Ingeniovirtual Com

Debt To Income Ratio Formula Calculator Excel Template

Dti Mortgage Calculator Cheap Sale 57 Off Www Ingeniovirtual Com

Debt To Income Dti Ratio What S Good And How To Calculate It

Auto Loan Calculator Calculate Car Loan Payments

Debt To Income Ratio Calculator

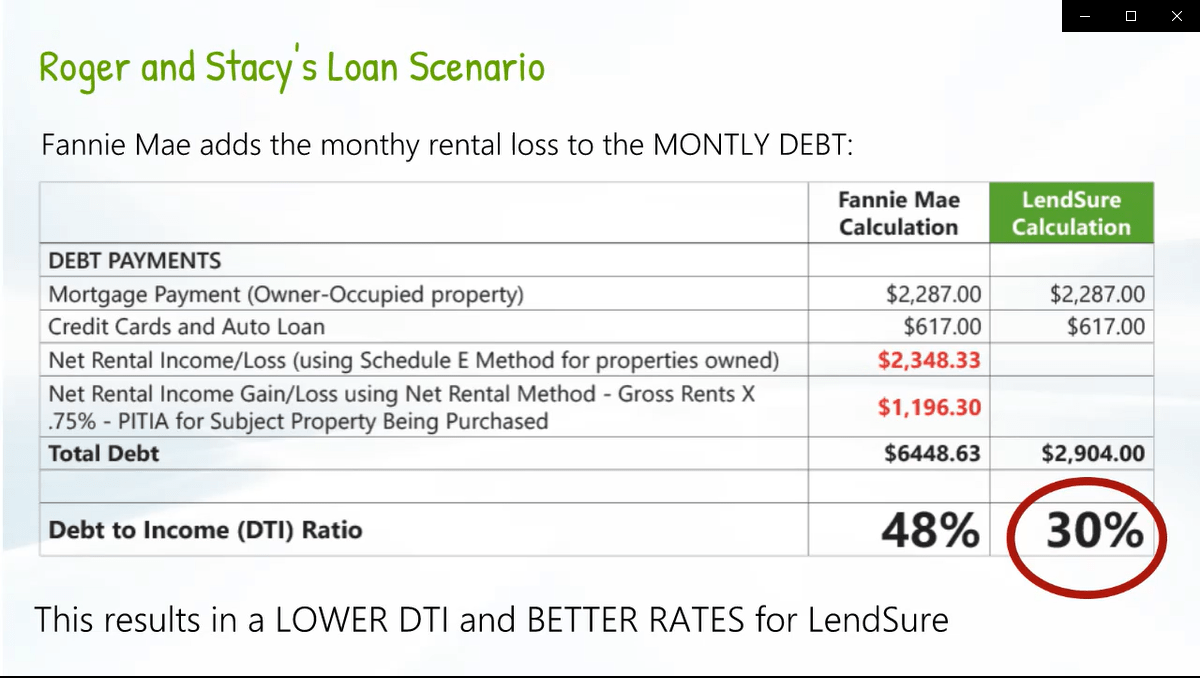

Rental Income Calculation For Better Dti Lendsure Mortgage Corp

What Is The Debt To Income Ratio Learn More Citizens Bank

Debt To Income Dti Credit Com

Debt To Income Ratio Dti Calculator

How To Calculate Debt To Income Ratio

Debt To Income Ratio Calculator On Sale 59 Off Www Wtashows Com

Debt To Income Ratio Calculator For Mortgage Approval Dti Calculator

What Is The Max Dti Ratio For A Car Loan Auto Credit Express

Dti Mortgage Calculator Flash Sales 52 Off Www Ingeniovirtual Com

How To Lower Your Dti Ratio